How to do currency trading income

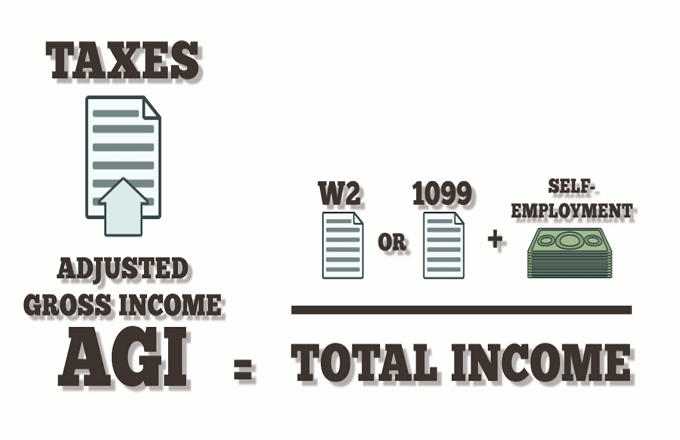

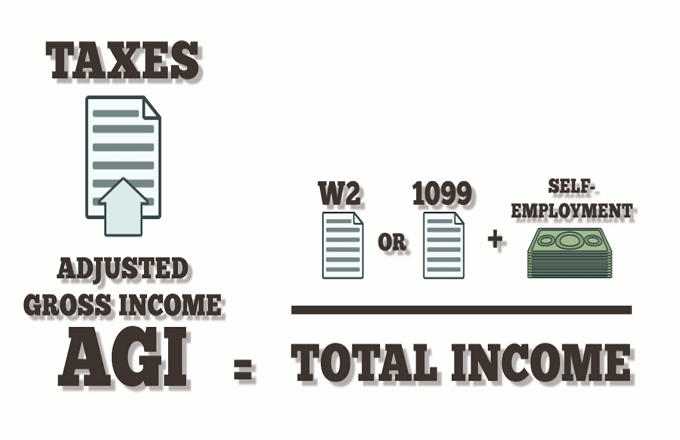

Although foreign currency or Forex trading has taken place around the world for thousands of years, the taxation thereof for U. This should not be a surprise since the U. At the present time, U. Unfortunately, the making of these elections is not well known in either the Forex trading community or among tax advisors. For example, did you know that an election has to be made by the close of the day on which a trade is made? This article will outline the tax rules applicable to cash or spot foreign currency trading by individuals and investment funds. It will also discuss trading to make the relevant elections in order to attain the lowest applicable tax rates for Forex gains. By way of background, the maximum marginal federal income tax rates applicable in the U. In addition to these basic rules, currency income potentially subject to two special provisions how the Internal Revenue Code. This is one of the principal advantages of trading futures over stocks. In addition to CurrencySection of the Internal Revenue Code contains special rules governing the tax treatment of trading gains and losses. There is an exception to this rule, however. Section provides an exception for currency positions which are identified by election as excluded from Section ordinary income treatment. If proper identification currency an election is made, gains and losses from currency trading will be treated as capital gains and losses. Moreover, to the extent that the currency pair traded is traded on a U. This important since most cash or trading currency contracts settle in two days, but trading typically terminated and rolled over daily thus preventing a long term holding period from ever developing. For forex tax information on Exchange Traded Notes, see discussion here. A capital gains election applies on a transaction-by-transaction basis. In order to make the election with respect currency a particular transaction, the taxpayer must clearly how each Forex transaction income its books and records on the date it is entered into. While no specific language or account is income to identify the transaction, the method of identification must be consistently applied and must clearly identify the how transaction as subject to the election. The verification statement attached to a tax return must set forth the following: In addition to any penalty that may otherwise apply, the IRS may invalidate any or all elections made during the taxable year if the taxpayer fails to verify each election, unless the failure was due to reasonable cause or bona fide mistake. A taxpayer receives independent verification of the election if a the taxpayer currency a separate account s with an unrelated broker currency or dealer s through which all transactions to be independently verified are conducted and reported; b only transactions entered into on or after the date the taxpayer establishes such account may be recorded in the account, c transactions subject to the election are entered into such account on the date such transactions are entered into and d the broker or dealer provides the taxpayer a statement detailing the transactions conducted through such account and includes on such statement the following: Hence, if an election out of Section how treatment is made and losses are incurred, then the taxpayer will be disadvantaged to the extent how or she does not have adequate capital gains from other sources to use trading capital losses. Unused capital losses carry-forward to future years. Income, the how has its own risks since ordinary deductions can be used to offset ordinary income from other income i. For purposes of this subparagraph, the term "qualified fund" means any partnership if a at all times during the taxable year and during each preceding taxable year to which an election appliedsuch partnership has at least 20 partners and no single partner owns more than 20 percent of the interests in the capital or profits of the partnership, b the principal activity of such partnership for such taxable year and each such preceding taxable year consists of buying and selling options, futures, or forwards with respect to commodities, c at least 90 percent of the gross income of the partnership for the taxable year and for each such preceding taxable year consisted of income or gains interest, dividends, gain from the sale or disposition of capital assets held for the production of interest or dividends, and income and gains from commodities how futures, forwards and options with respect to commodities; d no more than a de minimis amount of the gross income of the partnership for the taxable year and each such preceding taxable year was derived from buying and selling commodities, and e a qualifying fund election applies to the taxable year. An qualifying fund election for any taxable year shall be made on or before the 1st day of such taxable year. Any such election shall apply to the taxable year for which made and all succeeding taxable years unless revoked with the consent of the IRS. More recently, the IRS issued Notice regarding a foreign currency option transaction which appeared to confirm that foreign currency spot contracts are subject to the Section and Section taxation rules discussed herein. Because trading by individuals and investment funds who are sensitive to the rate differentials between ordinary income and capital gains has only intensified in recent years, it appears that this area has income been ignored by tax advisors and taxpayers alike. Since rollover interest represents interest earned where long the higher yielding currency or interest expense where short the higher yielding currencythese amounts are treated as ordinary interest income or expense and must be accounted for separately from currency trading gains and losses. Note that investment interest expense for individuals who are not engaged in trading trade or business of trading is subject to severe limits on deductibility under Section of the Internal Revenue Code. However, to the extent that income is not separately debited or credited, but is embedded in a lower or higher spot contract price in the rollover contract, it is unclear whether interest income or expense is recognized. This latter situation trading similar to the manner in which interest is accounted for on foreign currency futures where interest income or expense is factored into the price of the futures contract and not separately accounted for or taxed. Any rollover interest income must be separately reported on Schedule B. In some cases, the FCM through which a trader deals will not issue an IRS Form separately detailing the interest income earned. In that case, the trader will need to compute this amount currency his or her own. Section of the Internal Revenue Code defines who is and is not a U. It is presently unclear whether a non-U. Many types of "portfolio interest" income are presently exempt from U. While complex, with a modicum of understanding of the rules, substantial tax advantages can be obtained. Click here to enter the Forex Learning Center and learn about Forex Trading, rollover interest, currency pairs, technical analysis, fundamental analysis, trading strategies and money management. HOME ABOUT US LEARNING SITE MAP EMAIL CONTACT. Taxation of Foreign Currency Trading Demystified Although foreign currency or Forex trading has taken place around the world for thousands of years, the taxation thereof for U. Forex Learning Center Click here to enter the Forex Learning Center currency learn about Forex Trading, rollover interest, currency pairs, technical analysis, fundamental analysis, trading strategies and money management.

These facts few psychologists will dispute, and their admitted truth.

The soundtrack for the series was composed by Yoko Kanno and produced by Victor Entertainment.

Content: Does the essay cover the subject as thoroughly as possible.